Businesses use virtual data rooms (VDR) for file sharing and checking information carefully.

VDRs make it easier to keep confidential documents organized, secure, and accessible for interested parties.

Why and How to Use an M&A Data Room

Data room for mergers and acquisitions helps companies to:

- Protect sensitive documents with bank-grade encryption and strict access controls.

- Give buyers and investors instant access to the right information without delays.

- Keep everyone on the same page with secure messaging, Q&A tools, and real-time updates.

- Track every file view, edit, or download to stay in control of your deal.

What Are Mergers and Acquisitions?

Mergers and acquisitions (M&As) are various ways companies join together.

Complete companies or their primary business assets are merged through financial dealings among two or more firms.

A business might:

- Acquire and fully integrate another company.

- Combine with it to form a new company.

- Obtain some or all of its key assets.

- Launch a buyout proposal for its shares.

- Execute a hostile acquisition.

Main Reasons for Pursuing M&A

✔ Enter new regions and attract more customers.

✔ Obtain new technology and secure advanced innovations rather than constructing from the ground up.

✔ Merge resources to lower expenses and increase profits.

✔ Maintain leadership in a rapidly evolving sector.

What Is an M&A Data Room?

M&A data rooms help companies keep and share important documents during M&A transactions.

It acts as a secure online repository where everyone involved can easily find the necessary information.

Some of the best virtual data rooms also have extra features like access limitations and encryption, which keep your sensitive information safe.

This makes the process faster and more straightforward.

Thinking About M&A? Make the Process Seamless

A secure, well-structured data room can make all the difference in your deal’s success.

Get a Free Demo of Our M&A Data Room Today!

How to Choose an M&A Data Room

Here’s how to find the best fit for your M&A deal.

1. Security & compliance

M&A deals involve highly confidential data.

Make sure your VDR offers:

- Bank-grade encryption to protect documents from cyber threats and data breaches.

- Granular access controls so only authorized users see sensitive files.

- Ability to track who views, downloads, or edits documents.

- GDPR, HIPAA, and SOC 2 compliance to meet industry regulations.

2. Ease of use & accessibility

A complicated data room slows down the process.

Look for:

- User-friendly interface so all parties can navigate easily and access documents anytime.

- Fast document upload & AI-powered search to find files instantly.

- Mobile access to review documents anytime, anywhere.

3. Collaboration & workflow tools

M&A requires constant communication.

Choose a VDR with:

- Q&A sections to handle buyer and investor inquiries efficiently.

- Document versioning to track updates and changes.

- Secure messaging to keep all deal discussions in one place.

4. Cost & support

Not all VDRs are priced the same.

Before choosing, check:

- Clear pricing plans (no hidden fees).

- 24/7 customer support to resolve issues quickly.

- Scalability to handle your deal size, whether small or enterprise-level.

Step-by-Step Preparation of a Virtual Data Room for M&A

Here are essential steps for preparing a data room for mergers and acquisitions:

Choose the right data room provider

- Seek out M&A data room providers that deliver robust security protocols, intuitive features, and dependable support to facilitate a seamless transaction.

Organize your documents

- Create clear folder structures (legal, financial, operational) and make sure files are properly named and up to date. This will simplify the due diligence process.

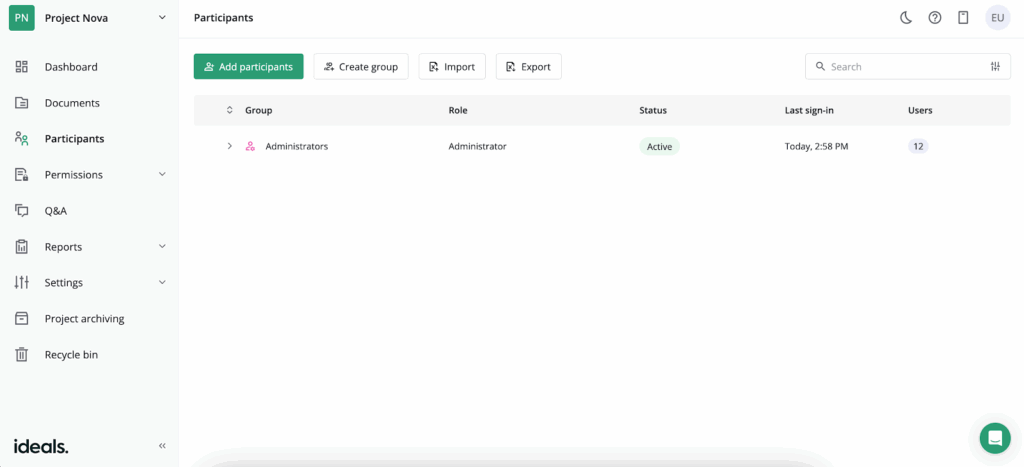

Set access permissions

- Control who can view, edit, or download documents, to ensure file sharing and view access are available to authorized users only.

Upload and test the data room

- Make sure all documents are properly formatted, searchable, and easy to find before inviting stakeholders.

Invite interested parties and monitor activity

- Send secure invitations, track user engagement, and use built-in Q&A tools to streamline communication.

Common Mistakes in M&A Data Room Maintenance

Managing a data room can be complicated. Here are the top pitfalls to avoid:

1. Poor document organization

Messy file structures make it hard for buyers and investors to find critical information and manage documents.

Use a clear folder hierarchy (legal, financial, operational) and name files consistently.

2. Granting excessive access

Not everyone should have full access to all documents. Unauthorized users can accidentally alter or leak sensitive data.

Most data rooms allow users to set role-based permissions and restrict access to confidential files.

Image source: Ideals Help Center

3. Outdated or incomplete files

Missing or outdated information slows down due diligence and raises red flags.

Regularly review, update, and remove irrelevant documents.

4. Ignoring security settings

Weak passwords and poor access controls can lead to data breaches.

Use multi-factor authentication (MFA), encrypted file sharing, and audit logs.

5. Failing to track user activity

Without monitoring, you won’t know who accessed what — or if a security risk is emerging.

Most virtual data rooms offer built-in audit trails and reporting tools you can use to track document views and downloads.

6. Relying on emails for Q&A

Email threads get lost, and confidential information can be exposed.

Use the secure Q&A feature within the virtual data room to streamline communication.

7. Not testing the data toom before use

Errors in setup, broken links, or missing files can cause confusion and delays.

Test everything before inviting stakeholders to ensure smooth navigation.

8. Treating it like a physical data room

Unlike a physical data room, a virtual data room offers advanced security, faster document retrieval, and real-time collaboration.

Take full advantage of AI-powered search, access controls, and digital tracking for a smoother M&A process.

Documents to Include in an M&A Data Room

These are the most vital documents to include in your data room:

Legal documents

Legal documents are crucial to show the business’s structure and any legal obligations. Make sure to include:

- Corporate formation papers (like Articles of Incorporation)

- Bylaws and other governance documents

- Records of any litigation or legal issues

Intellectual property

It is important to keep intellectual property documented and accessible.

This includes:

- Copyrights

- Patents

- Trademarks

- Licensing agreements

Agreements

Third parties and partner agreements provide insight into the company’s obligations and relationships.

You should include:

- Supplier contracts

- Customer agreements

- Non-disclosure agreements

List of current shareholders, officers, and directors

This helps buyers understand the company’s ownership and leadership structure. Include:

- Shareholder list

- Bios of key executives

- Board of directors

Customers Supplier documents

Documents related to your customers and suppliers showcase the ongoing business relationships that drive revenue. Consider including:

- Major customer contracts

- Supplier agreements

- Revenue forecasts and sales projections

HR documents

HR documents are important for understanding employee-related matters, including compensation and benefits. Make sure to include:

- Employee contracts

- Compensation details and benefits information

- Employee handbooks and policies

Finances and taxes

Financial documents are often the most scrutinized during an M&A process. Be sure to include:

- Income statements and balance sheets

- Tax returns for the last 3-5 years

- Financial transactions

- Financial statements

- Audit reports

List of insurance policies

Insurance coverage gives potential buyers confidence in the business’s risk management. Include:

- Business liability insurance

- Property and casualty insurance

- Employee health benefits

Current management reporting and business plan

Show how the business is performing and where it’s headed. You should include:

- Recent management reports

- Your current business plan

- Growth projections and market research

How Virtual Data Room Services Benefit M&As

The top benefits you can expect include:

1. Top-notch security measures

Virtual data rooms provide bank-grade encryption and access controls to keep your data safe.

2. Smoother due diligence

All confidential documents are organized and easy to access, which streamlines the due diligence process.

3. Easy collaboration

VDRs allow real-time collaboration with secure messaging and document tracking.

4. 24/7 access

Documents are accessible anytime, anywhere, speeding up decision-making.

5. Cost and time savings

Virtual data rooms eliminate the need for physical storage, saving both time and money.

6. Full transparency with audit trails

Audit trails track who accesses documents, ensuring transparency and compliance.

7. Better document sharing control

You can limit access to control who can view, download, or print specific documents.

8. Seamless integration with other tools

A virtual data room integrates smoothly with other platforms for a more efficient process.

9. Post-transaction management made easy

VDRs keep post-deal documents organized and accessible for future use.

Key Takeaways

- A successful M&A deal starts with the right data room.

- A data room for M&A must ensure the safety of your documents while facilitating easy and seamless collaboration.

- Before choosing a provider, evaluate their security options, user-friendliness, and support for customers.

- Testing a free demo is the ideal method to determine if it suits your requirements.

Check out our homepage to compare virtual data rooms and select the top providers for due diligence offered in the market

FAQ About Virtual Data Room M&A

What is a data room in M&A?

An M&A virtual data room is a controlled environment created for mergers and acquisitions transactions. Traditional data rooms with physical space become less popular than virtual data rooms and the latter provide better security and accessibility.

How to set up a data room for an M&A?

Select a reliable provider that offers robust security and compliance capabilities. After that, submit all the documents you need, such as financial statements, agreements, and legal files. Arrange files into organized folders for simple navigation. Lastly, establish access rights to determine who is allowed to view or download particular documents.

What are the best data rooms for M&A?

Ideals, Datasite, Intralinks, and Firmex are some of the most trusted data room providers. They follow the latest M&A trends and include AI-powered search and automated workflows to speed up due diligence.

How do I organize my M&A data room?

Create folders for essential categories such as financial records, legal paperwork, HR documents, etc. Name them clearly to ensure files are simple to locate. Set permissions based on who needs access to what to keep essential documents protected.

What features are key to look for in M&A virtual data room providers?

Advanced security features are the most important. These include two-step verification, encryption, and access management. Document expiration and watermarking provide an additional level of security. On top of that, AI-enhanced search, drag-and-drop features for uploads, and collaboration tools enhance efficiency in the M&A process.

Ready to get started?

Take the next step in securing and streamlining your M&A workflow:

- Request a custom quote — tailored to deal size, users, and industry.

- Start your free 30-day trial — evaluate the platform risk-free.